One repeatable workflow.

Hedgtrade turns market structure, seasonality, and cycle analysis into decision-ready risk outputs — so teams can frame trades with consistency: regime → scenarios → boundaries → exposure drivers.

Benefits at a glance

The goal is simple: fewer ad-hoc decisions, clearer boundaries, and faster alignment across teams.

Better decisions

Timely, explainable context built for desks and investment committees.

Drawdown control

Stress outcomes + boundaries reduce reactive hedging and surprise moves.

Consistency

Repeatable framing across regimes — and across meetings.

Coverage

Multi-asset universe (indices, FX, commodities, ETFs, equities, more).

Delivery

Dashboards + email briefs by default, API when you need it.

Confidence

Quantified outputs reduce uncertainty and decision fatigue.

How it works

A clean sequence that keeps actions consistent — even when volatility expands.

Feature highlights

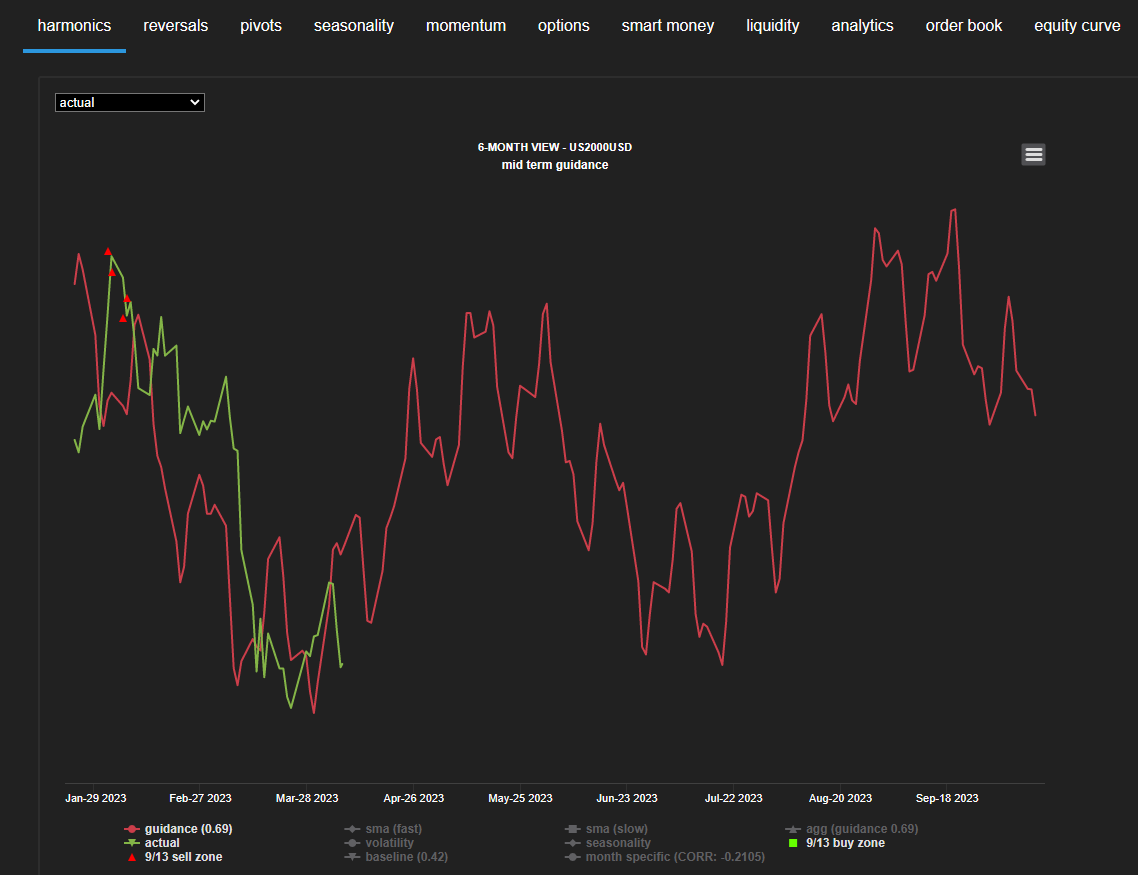

Collective sentiment & cycles

Cycle analysis + seasonalities + forward-looking metrics to frame risk-adjusted trends. Use models as inputs to a disciplined plan — not as standalone predictions.

- Cycle windows to reduce whipsaw

- Seasonality intervals + repeating cohort behavior

- Signal context for “what changed”

Platform highlights

- Multi-asset support across major asset types

- Short / mid / long horizon views

- Dashboards + email briefs for cadence

- API for workflows and automation

Machine learning integration

ML-driven models blend projections with signals and seasonality overlays — designed to stay explainable and operational in review meetings.

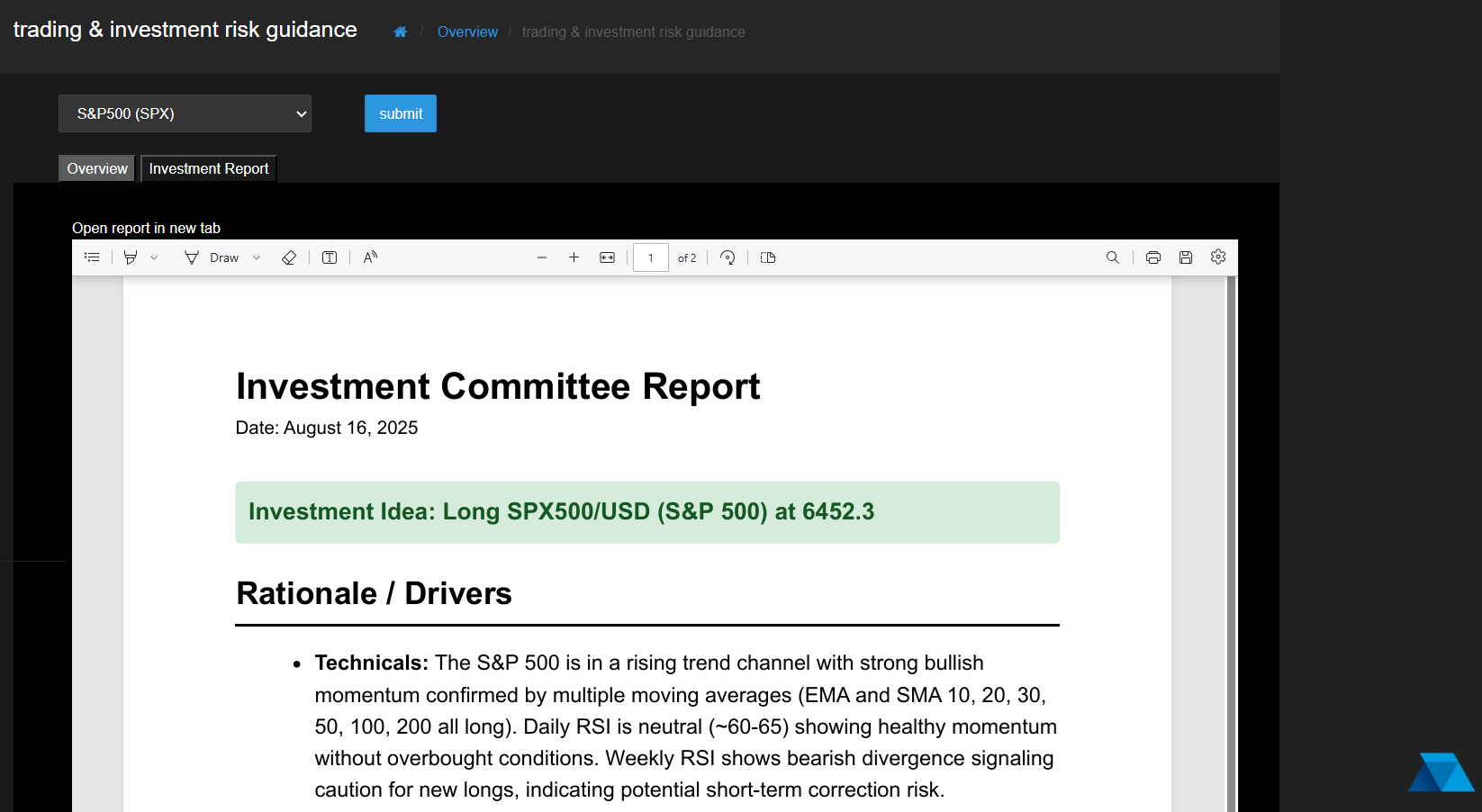

Example outputs

What teams actually use: clear visuals + governance-friendly exports.

Standardized one-pagers package: idea → drivers → boundaries → exposure impact → governance notes.

- Consistent framing across meetings

- Exportable for review and audit packs

- Easy to distribute (PDF/HTML/email)

See Hedgtrade on your universe

We’ll demonstrate the workflow end-to-end: regime snapshot → scenario map → risk boundaries → exposure attribution.