Cyclicality Models Running in Real Time For 2600+ instruments

Supports more than 2600+ financial instruments, provides L/S trading bias in real time, as well as fully documented reporting dashboards that are updated non stop

Multi Asset Class & Template Driven

The platform is template driven in that any instrument can be mapped and onboarded onto the platform The following asset classes are currently supported: US indices, Major/Minor/Exotic FOREX pairs, Commodities, Metals, Crypto (Bitcoin), Treasuries/Bonds, ETF – country, ETF – sector US Stocks – DJIA constituents, US Stocks – SP500 constituents, US Stocks – Russell 2000 constituents

Forward Looking Analytics for the US Stock Market

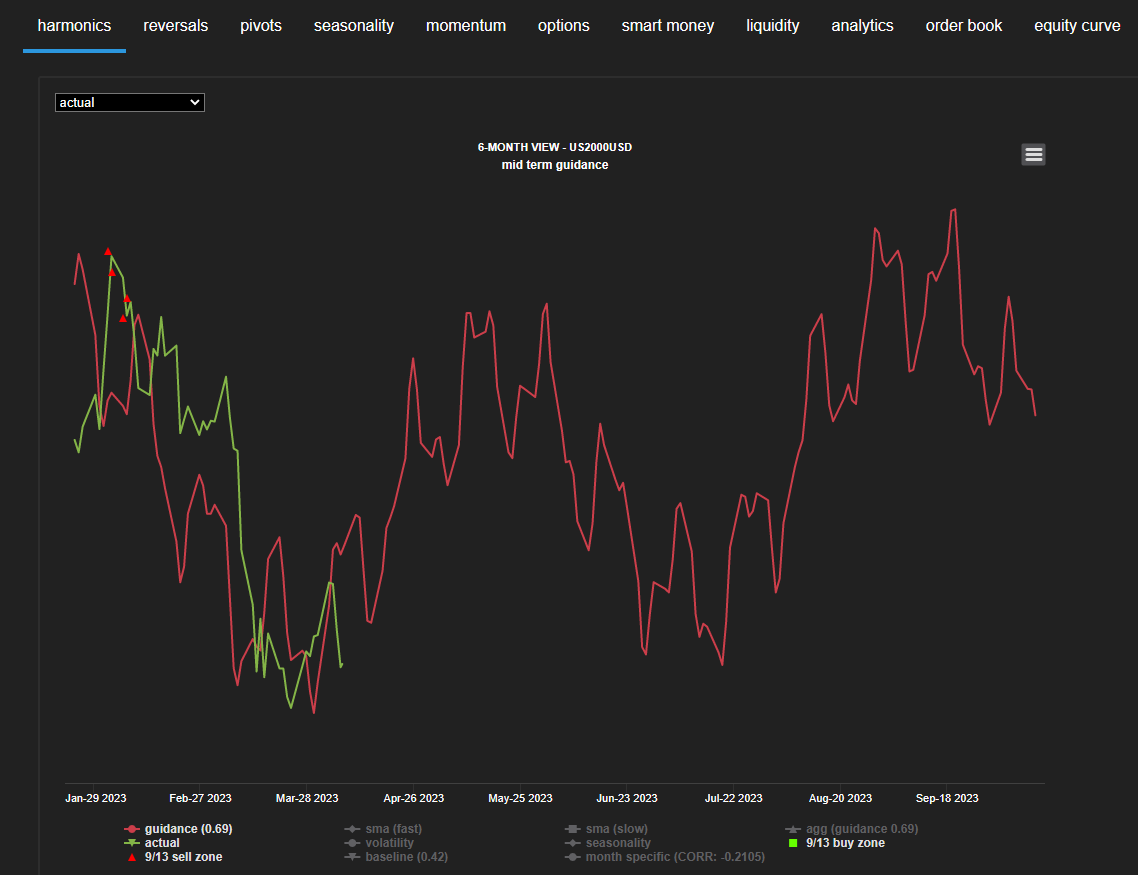

One of the keys if not the key requirement to being successful in trading is not to look at what has happened (think "technical analysis"), but rather to look at data sets that provide a forward looking outlook. The Hedgtrade platform provides short, mid and long term forward looking projections and detailed guidance. Reach out today for a few sample screenshots and additional information, or even a short product demonstration

Efficient Design, Great Visual User Experience & API Library for Automation

Pointless to say, data sets and predictive analytics are as good as the publishing mechanism that's used to consume them. We have spent a massive amount of time in listening to our customers' feedback and ideas and thats an approach that will never change with Hedgtrade. A library of RESTful Web Services (API) is also made avaialble to those that require integration and automation, we are ourselves quite tech savvy and can help you customize any workflow you may require. Pleaae reach out and let us know your requirements

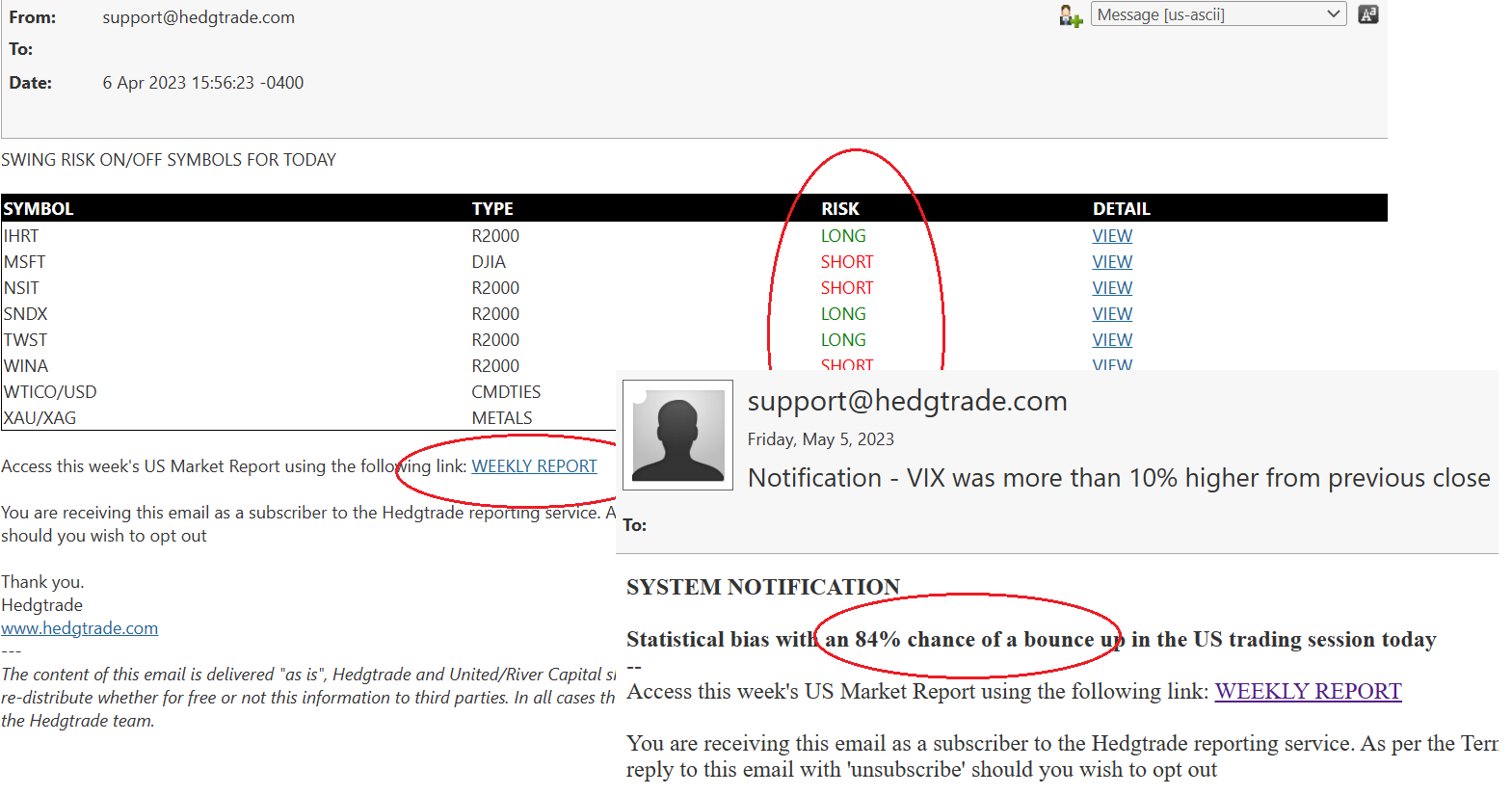

Real Time Email Alerts

Machine Learning (ML) using Supervised Modelling & Cyclical Regression

Available for 2600+ instruments, combine these projections along with additional markers, included but not limited to buy/sell signal logic and various tyoes of seasonalities among others

- Increased Profitability - By using our forecasting service you gain a significant edge in your investment and trading strategy, resulting often in increased profits

- Time Saving- The service saves you time by providing you with the most important information you need to make informed investment decisions

- Reduced Risk - Our predictions and analysis help you minimize risk by avoiding underperforming investments and drawdown

- Access to proprietary technology - Our service utilizes proprietary technology and algorithms that are not available to the general public, providing you with a competitive advantage

- Increased transparency - Our visual dashboards provide you with a clear and transparent understanding of the market, allowing you to make informed decisions with confidence

- Ease of use - Our visual dashboards are user-friendly and easy to understand, making it simple again for you to make informed investment decisions