Institutional API for Risk Signals, Models & Explainable Market Intelligence

Designed for asset managers, hedge funds, and research teams that require deterministic signals, auditable features, and enterprise controls. Integrate the same analytics that power Hedgtrade into your OMS, research pipeline, or client reporting.

- 2,600+ instruments covered across all major asset types

- 1H / 1D / 1W / 1M multi-TF signals

- Email · Visual Dashboards · API delivery options

- SDK delivery options | C# · RestAPI (web services)

- Minutes to first insights

At a Glance

API key auth · Low-latency JSON · Deterministic outputs · Audit-friendly metadata · Rate limits & burst control · IP allowlisting · Sandbox mode

curl -s \ \

-H "X-API-Key: <YOUR_KEY>" \

"https://api.united-river.com/v1/signals/US2000?tf=1D"Why Hedgtrade for Institutions

Deterministic Signals

Production-grade outputs (trend, momentum, reversal, seasonality and many more) with confidence scores and model inputs exposed for governance.

Coverage that Matters

US indices, major equities, liquid FX pairs, and popular ETFs. Historical depth suitable for backtesting & regime analysis.

Explainability

Every call response is supported by the underlying Hedgtrade dashboards and models that support investment committee review and brings transparency.

Reliability

Designed for 24/5 markets with weekend maintenance windows.

Support & SLAs

Priority incident routing, shared channels.

Security & Governance

Authentication

Use the X-API-Key header. Keys can be scoped (read-only, sandbox-only, rate limits) and rotated without downtime.

GET /v1/signals/SPY?tf=1D HTTP/1.1

Host: api.united-river.com

X-API-Key: <YOUR_KEY>

Accept: application/jsonQuickstart

- Request access → receive sandbox & production keys

- Whitelist outbound IPs & set quotas

- Call your first endpoint (examples below)

curl -s -H "X-API-Key: $HEDGTRADE_API_KEY" \

"https://api.united-river.com/v1/signals/US2000?tf=1H&limit=1" | jq

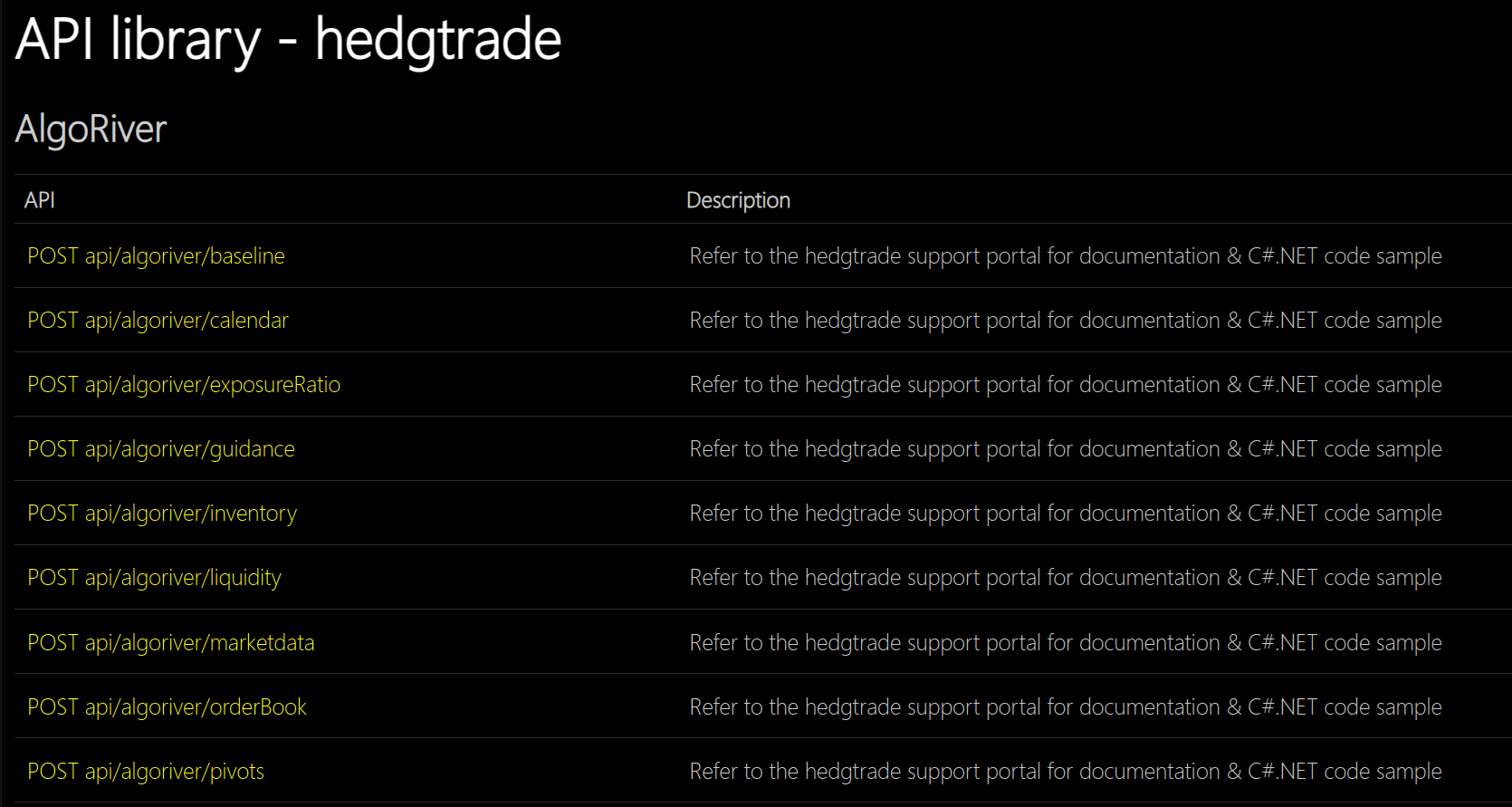

Core Endpoints

| Method | Endpoint | Description |

|---|---|---|

| GET | /v1/instruments?query=US2 |

Search instruments and retrieve metadata / canonical symbols. |

| GET | /v1/signals/{symbol}?tf=1D&limit=200 |

Deterministic trading signals with confidence scores, features & timestamps. |

| GET | /v1/seasonality/{symbol}?window=252 |

Seasonality curves and cohort stats for the chosen lookback window. |

| GET | /v1/technicals/{symbol}/rsi?tf=1H |

Computed indicators (e.g., RSI/ATR/MA) aligned to exchange calendars. |

| POST | /v1/portfolio/score |

Batch-score a list of tickers and timeframes (JSON body) for ranking & construction. |

Sample Response

{

"symbol": "US2000",

"tf": "1D",

"asOf": "2025-08-14T09:30:00Z",

"signal": {

"type": "trend_up",

"confidence": 0.74,

"strength": 0.62,

"ttl": 1440

},

"explain": {

"features": {

"seasonality_q3": 0.21,

"rsi_14": 0.18,

"atr_squeeze": 0.12

},

"recent": ["Higher low vs prior swing", "Breadth improving"]

}

}Parameters & Conventions

- tf: 1M · 1W · 1D · 4H · 1H

- limit: max rows returned per call

- Pagination via next cursor (RFC 5988 style)

- All timestamps are UTC ISO-8601

- HTTP cache: ETag & Cache-Control

Operations, SLAs & Support

Uptime & Throughput

- Transparent status page with incident postmortems

- Edge caching for frequently requested endpoints

Help When You Need It

- Email: support@hedgtrade.com

- Onboarding & solution design for enterprise

FAQ

How are limits enforced?

Per-key quotas and rolling windows. Headers return X-RateLimit-Remaining and Retry-After on 429.

How do I deploy on-prem or VPC?

We do not deploy on prem, Hedgtrade a cloud based model.

Do you provide audit logs?

Yes—access logs per key with timestamps, IP, and endpoint. Export via CSV or API.

What about compliance?

No personal data processed; responses include risk signal related fields to assist investment teams, internal governance and model risk oversight.

DISCLAIMER

Hedgtrade provides market intelligence and analytical tools for informational purposes only. We do not execute trades or provide personalized investment advice. All users are responsible for their own trading decisions and must comply with applicable regulations in their jurisdiction.