Collective Sentiment & Cycles

Trade in probabilities, not guesses. Hedgtrade turns market structure, seasonality, and cycle analysis into deterministic risk signals—so you minimize drawdowns and capture high-quality opportunities.

- Forward-looking ML engine forecasting cyclically adjusted outcomes across short, mid, and long term.

- Real-time time-series for seasonality, reversals, pivots, cyclically adjusted RSI, liquidity projections, and more.

- 2,600+ instruments maintained in real time, 7+ years of development, 3.8M+ lines of code.

Short demo: dashboards, alerts, and model outputs.

Benefits at a Glance

Insights into Market Trends

Forward projections across FX, US indices, commodities, metals, crypto, ETFs, and equities.

Better Decisions

Timely, explainable signals and context—built for investment committees and trading desks.

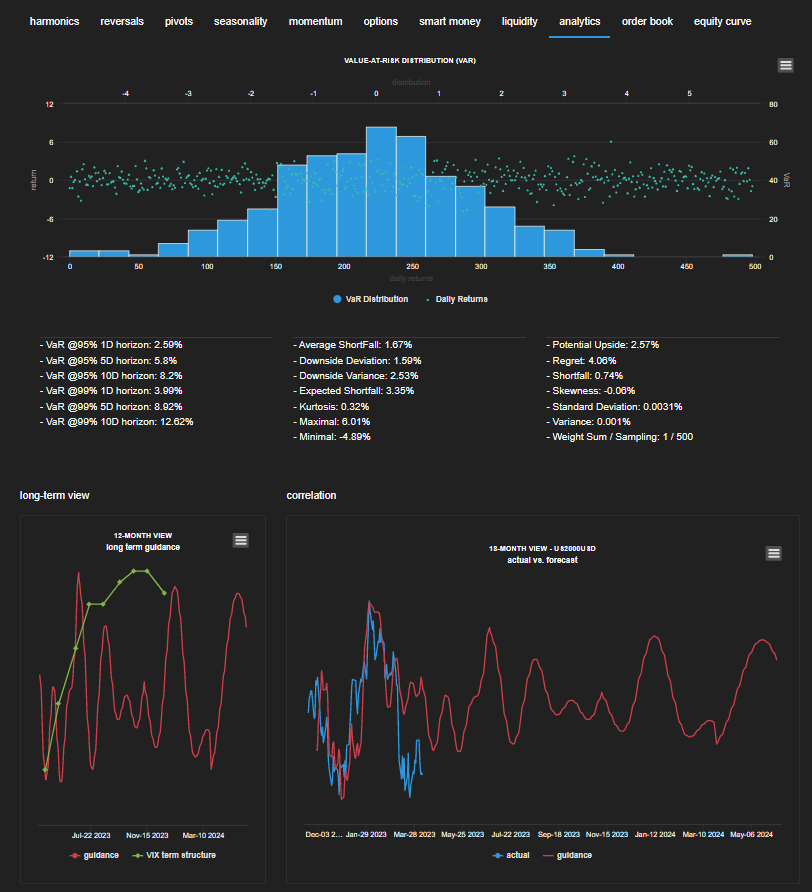

Drawdown Control

Risk-aware models reduce surprise moves and help optimize position sizing.

Visual Experience

Clean dashboards, daily emails, and API access to integrate into workflows.

Consistency

Statistical models and cohort testing deliver repeatable insights across regimes.

Confidence

Reduce uncertainty and decision fatigue with quantified, explainable outputs.

Example: Value at Risk (VaR) visual for portfolio oversight.

Retail & Institutional Investors

Confidence in the constant flux of markets. For advanced teams, integrate via APIs into existing automation.

Financial Advisors

Statistically adjusted predictive models to enhance consistency and client outcomes. We collaborate to fit your process.

Algorithmic Traders

Advanced analytics and a robust API library let you embed predictive signals into execution and strategy.

Features

Collective Sentiment & Cycles

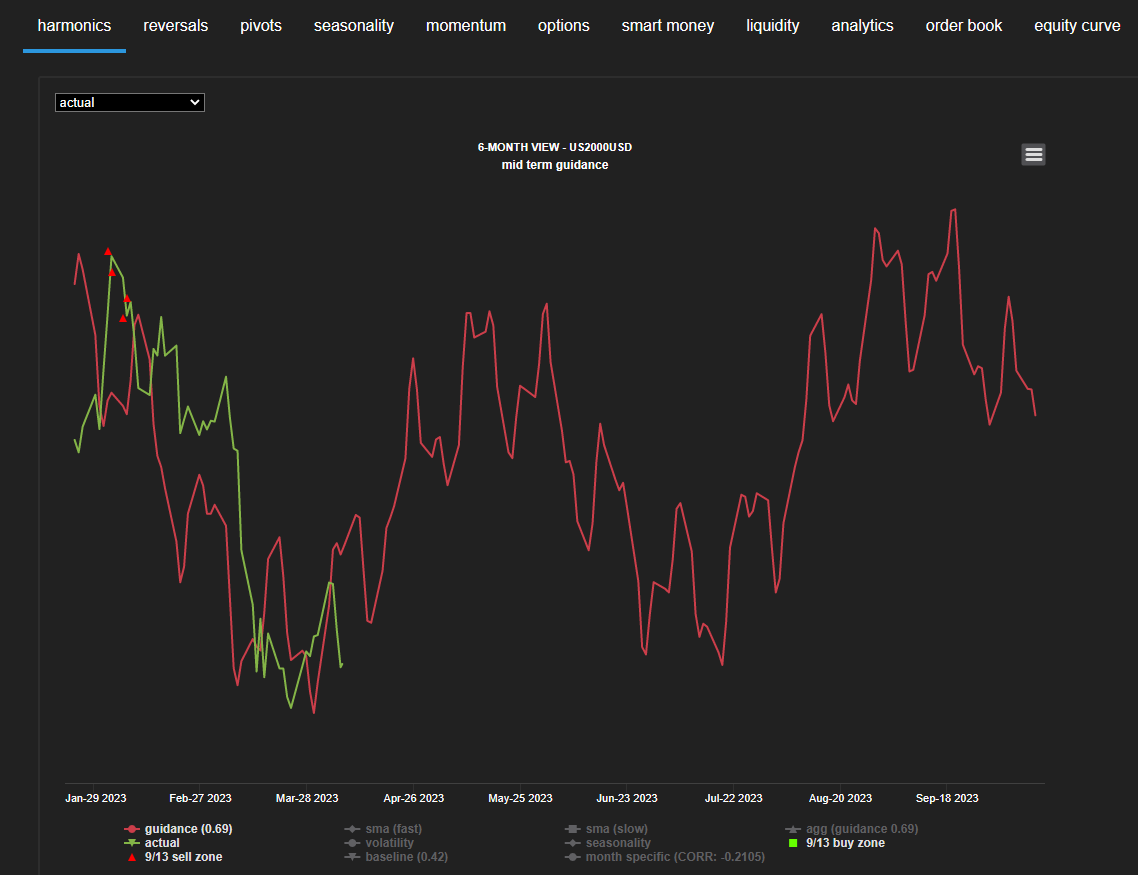

Cycle analysis and multi-pattern seasonalities, combined with forward-looking metrics, provide a comprehensive approach to predicting risk-adjusted trends. Markets are complex—use models as inputs to a clear plan.

Cycle analysis identifies patterns to forecast trends; seasonality highlights recurring intervals. Coupled with our aggregated retail order book, these methods surface actionable edges—often paired with fundamentals and macro.

Platform Highlights

- Cyclicality Models in Real Time: 2,600+ instruments with documented dashboards and long/short bias.

- Multi-Asset Class Support: Indices, FX, commodities, metals, crypto, bonds, ETFs, and stocks.

- Forward-Looking Analytics: Short, mid, and long-term projections for the US market.

- Seamless Design & API: Clean dashboards and RESTful APIs for automation and customization.

Machine Learning Integration

ML-driven models for 2,600+ instruments blend projections with signals, seasonalities, and more—delivering robust, explainable insights.

DISCLAIMER

Hedgtrade provides market intelligence and analytical tools for informational purposes only. We do not execute trades or provide personalized investment advice.

All users are responsible for their own trading decisions and must comply with applicable regulations in their jurisdiction.