Supervised Models & Cyclical Regression

We combine cyclical regression, supervised learning, and cohort seasonality to produce deterministic, explainable risk signals—continuously across 2,600+ instruments.

- Real-time engine forecasting short, mid, and long-term outcomes.

- Signal transparency with drivers, reversals, and confidence.

- Multi-asset coverage across indices, FX, commodities, metals, crypto, ETFs, and stocks.

Short overview: cyclical regression + supervised models in practice.

Collective Sentiment & Cycles

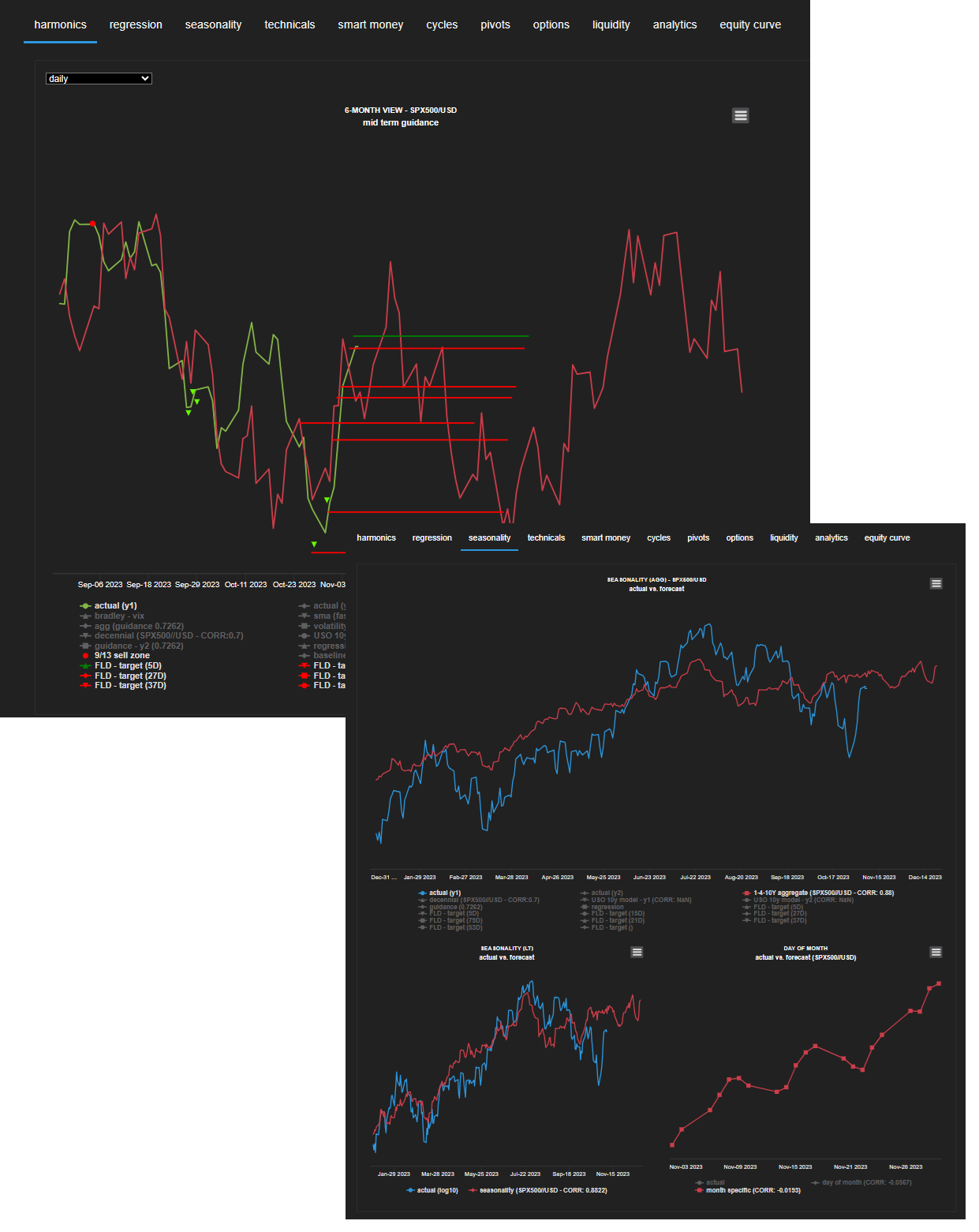

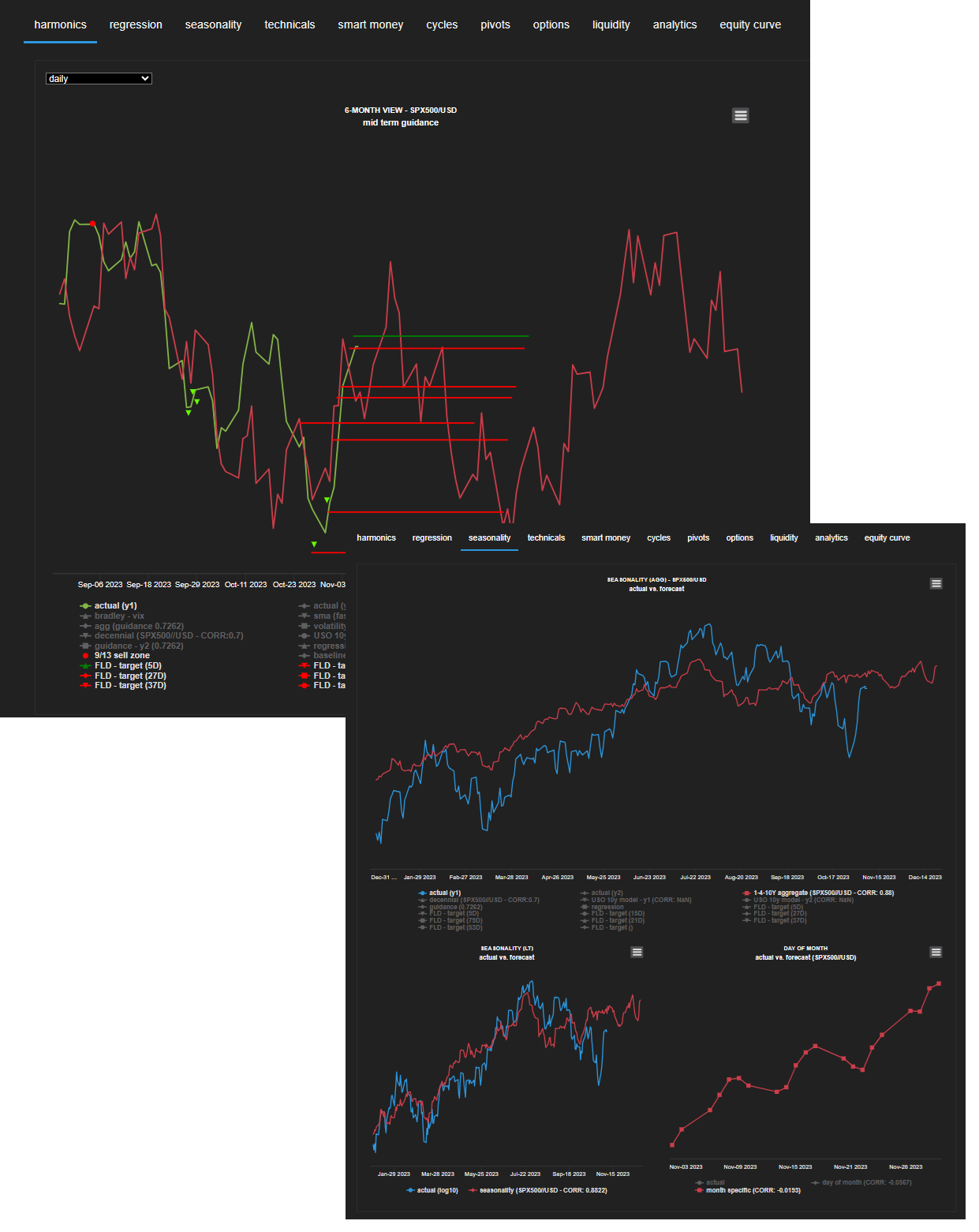

Markets can be humbling—yet their rhythms reflect collective behavior. Hedgtrade fuses statistics and cycle theory to quantify that structure and publish it in real time via interactive dashboards.

Cyclical Regression

Our continuously-evolving algorithms estimate risk parameters of oscillatory models, tracking thousands of instruments. Built from the ground up for performance, the platform blends cyclical projections with seasonality, trend/momentum, dark-pool & order-book data, and liquidity signals.

What You’ll Get

- Explainable signals with drivers, confidence, and timestamps.

- Reversal levels supportive of TP/SL planning and drawdown control.

- Seasonality cohorts (aggregated, decennial, election, day-of-month, etc.).

- Order-book & liquidity context and macro overlays (e.g., USD, VIX).

- Delivery via Dashboards · Email · API.

How the ML Pipeline Works

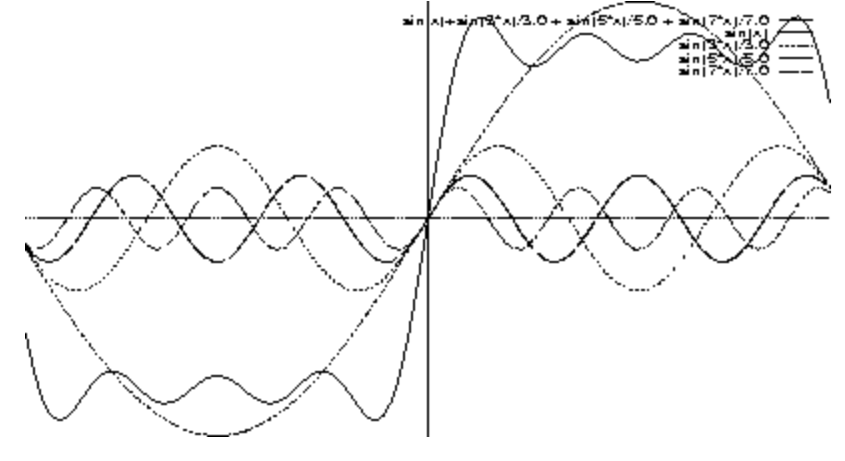

1) Decompose & Detect

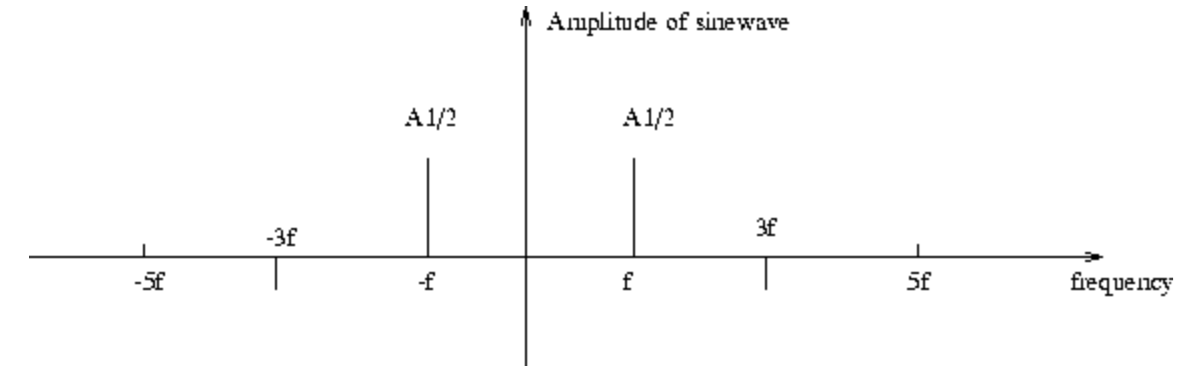

Fourier-like transforms identify dominant harmonics; trend and momentum features enrich the state.

2) Filter & Align

Dominant cycles are filtered and aligned with regime/seasonal cohorts to reduce noise and overfit risk.

3) Project & Explain

Supervised models produce time & price projections with explainability and reversal points.

Projection Example

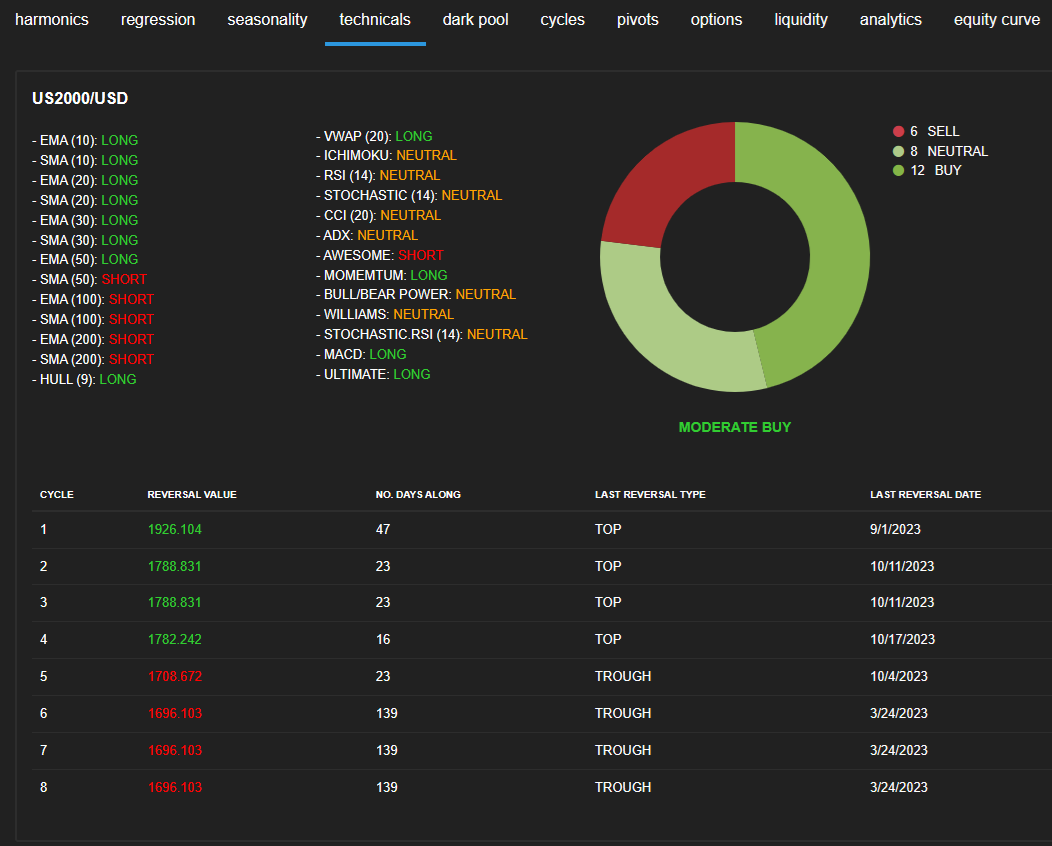

Example projection (Russell 2000) over the next weeks. The thesis is built from the sum of evidence—cycles, seasonality, order book, liquidity, VIX/USD context, and technicals.

Reversals, Trends & Momentum

The regression model publishes potential reversal zones for TP/SL planning, alongside composite trend & momentum metrics to keep emotions (and FOMO) out of the process.

DISCLAIMER

Hedgtrade provides market intelligence and analytical tools for informational purposes only. We do not execute trades or provide personalized investment advice.

All users are responsible for their own trading decisions and must comply with applicable regulations in their jurisdiction.