Institutional API for risk signals, models & explainable market intelligence.

Integrate the same analytics that power Hedgtrade into your OMS, research pipeline, dashboards, or reporting workflows — with deterministic outputs and audit-friendly metadata.

- 2,600+ instruments covered across all major asset types

- 1H / 1D / 1W / 1M multi-TF signals

- Email · Visual Dashboards · API delivery options

- SDK delivery options | C# · RestAPI (web services)

- Minutes to first insights

At a glance

API key auth · Low-latency JSON · Deterministic outputs · Audit-friendly metadata · Rate limits & burst control · (scope-based) IP allowlisting · (scope-based) sandbox keys

curl -s -H "X-API-Key: <YOUR_KEY>" \

"https://api.united-river.com/v1/signals/US2000?tf=1D"Need a scoped key (read-only / sandbox-only / per-endpoint limits)? Request access and we’ll configure it.

Why institutions use Hedgtrade API

- Deterministic signals: trend, momentum, reversal, seasonality and more with confidence.

- Explainability: responses map back to underlying dashboards/models for governance review.

- Coverage: indices, equities, ETFs, FX, metals, commodities, crypto (as available in-platform).

- Workflow-friendly: batch scoring, watchlists, reporting templates, and exports.

Security & governance

Authentication

Use the X-API-Key header. Keys can be rotated and scoped (scope-based) without downtime.

GET /v1/signals/SPY?tf=1D HTTP/1.1

Host: api.united-river.com

X-API-Key: <YOUR_KEY>

Accept: application/jsonOperational controls (pragmatic)

- TLS: transport security for web/API traffic

- Rate limits: per-key quotas; 429 with retry guidance

- Audit metadata: timestamps, symbol, timeframe, and response context

- Scope-based controls: IP allowlisting, sandbox keys, endpoint restrictions

Decision-support only — no execution and no custody.

Quickstart

- Request access → receive keys (and scope where required)

- Set quotas / (scope-based) allowlist IPs

- Call your first endpoint (examples below)

curl -s -H "X-API-Key: $HEDGTRADE_API_KEY" \

"https://api.united-river.com/v1/signals/US2000?tf=1H&limit=1"Core endpoints

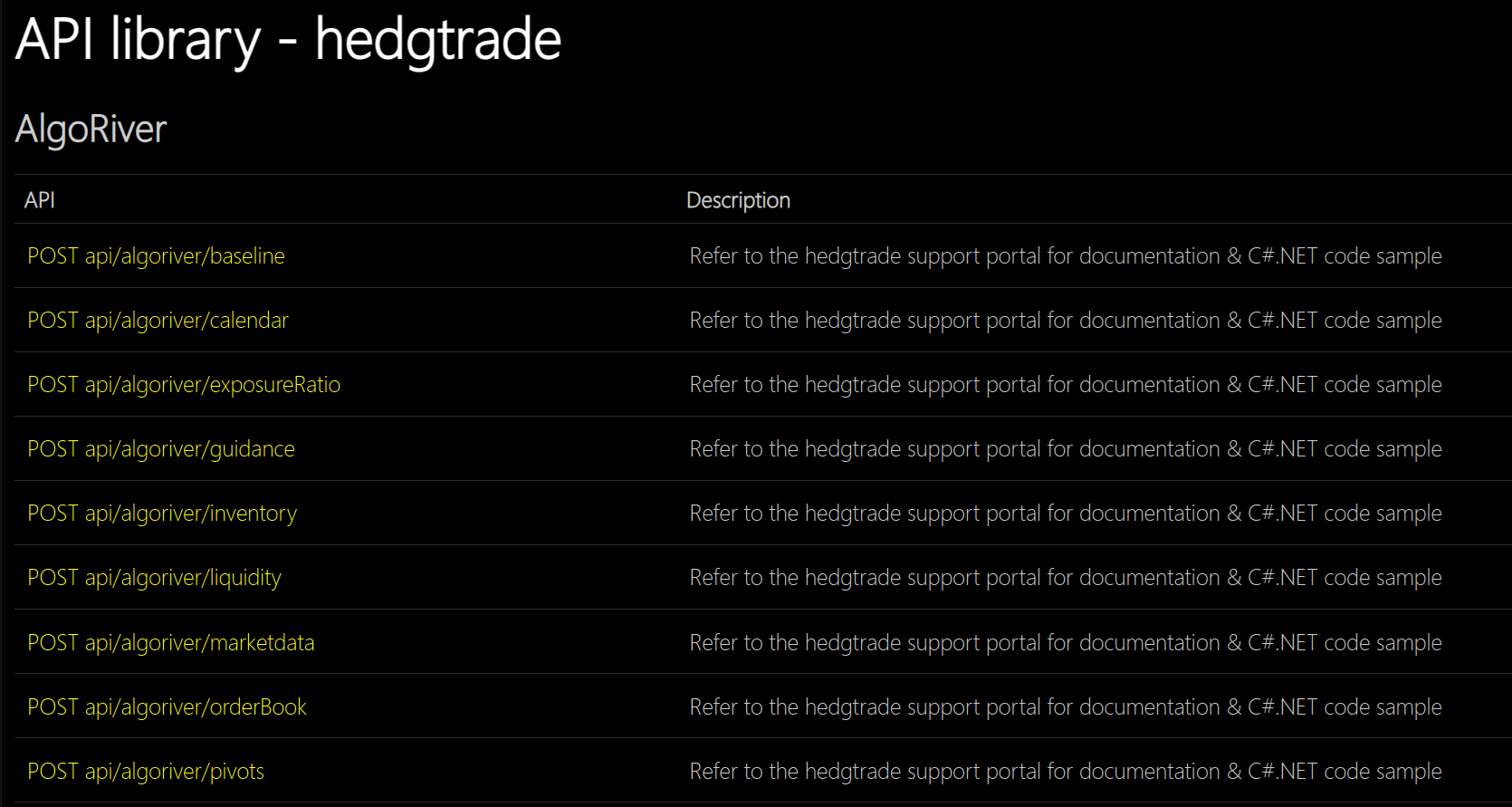

| Method | Endpoint | Description |

|---|---|---|

| GET | /v1/instruments?query=US2 |

Search instruments and retrieve metadata / canonical symbols. |

| GET | /v1/signals/{symbol}?tf=1D&limit=200 |

Deterministic signals with confidence and timestamps. |

| GET | /v1/seasonality/{symbol}?window=252 |

Seasonality curves and cohort stats for the selected lookback window. |

| GET | /v1/technicals/{symbol}/rsi?tf=1H |

Computed indicators (e.g., RSI/ATR/MA) aligned to exchange calendars. |

| POST | /v1/portfolio/score |

Batch-score a list of tickers/timeframes (JSON body) for ranking & construction. |

Sample response (shape)

{

"symbol": "US2000",

"tf": "1D",

"asOf": "2025-08-14T09:30:00Z",

"signal": { "type": "trend_up", "confidence": 0.74, "strength": 0.62 },

"explain": {

"features": { "rsi_14": 0.18, "atr_squeeze": 0.12 },

"recent": ["Higher low vs prior swing"]

}

}Exact fields depend on endpoint and scope; the goal is consistent, auditable outputs.

Conventions

- tf: 1M · 1W · 1D · 4H · 1H

- limit: max rows returned per call

- All timestamps are UTC ISO-8601

Operations & support

- Onboarding & solution design for enterprise integrations

- Support email: support@hedgtrade.com