Explainable projections from cyclical regression + supervised models.

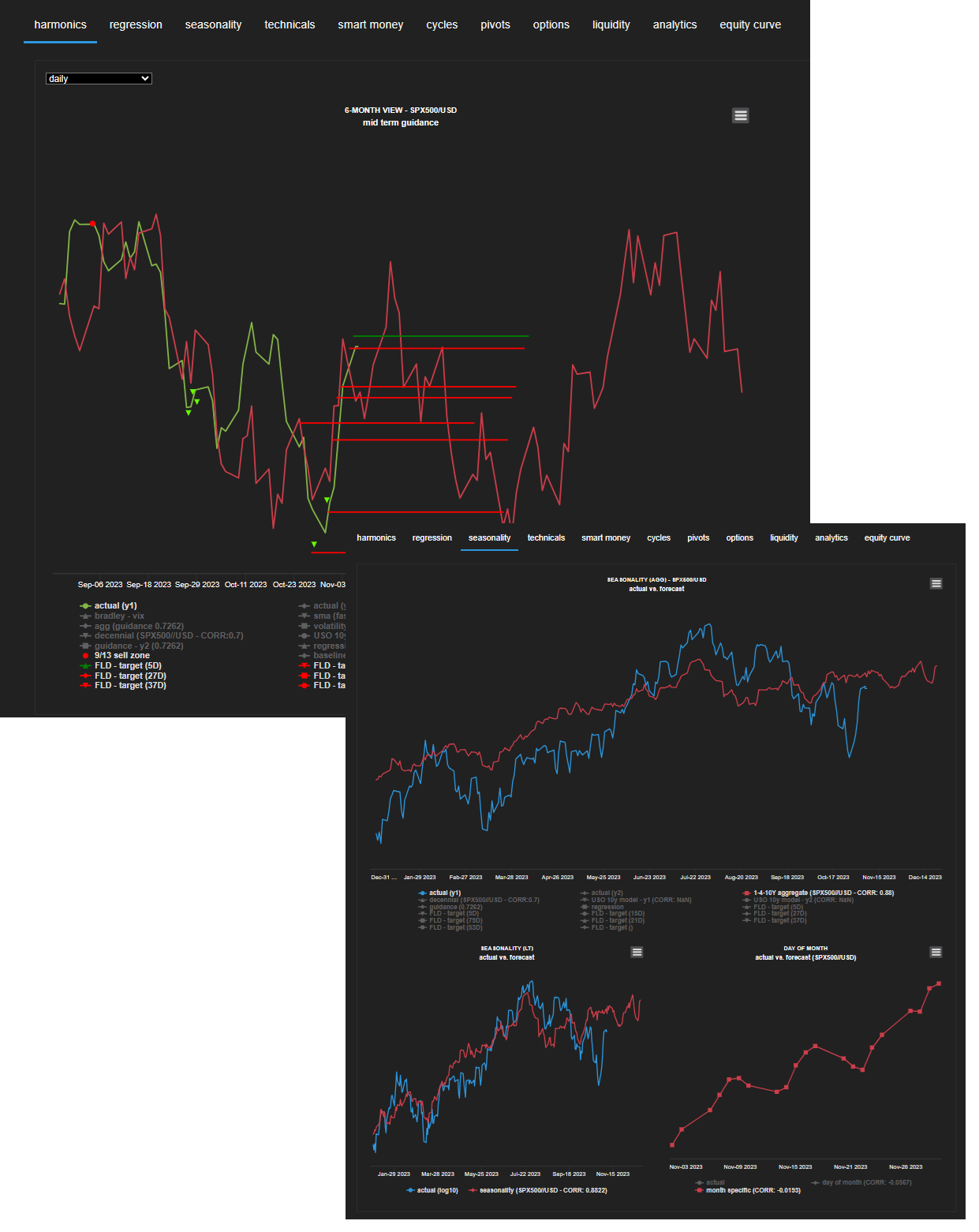

Hedgtrade combines harmonic decomposition, regime/seasonality cohorts, and supervised learning to publish decision-ready risk signals with drivers, reversal zones, and confidence — continuously across 2,600+ instruments.

A repeatable ML workflow that turns market structure into compact features, then outputs projections and risk states that can be discussed, governed, and acted on with consistent boundaries.

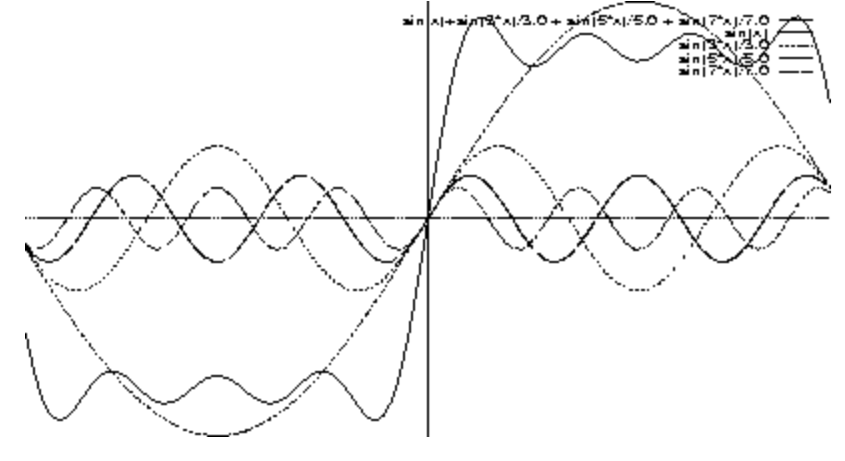

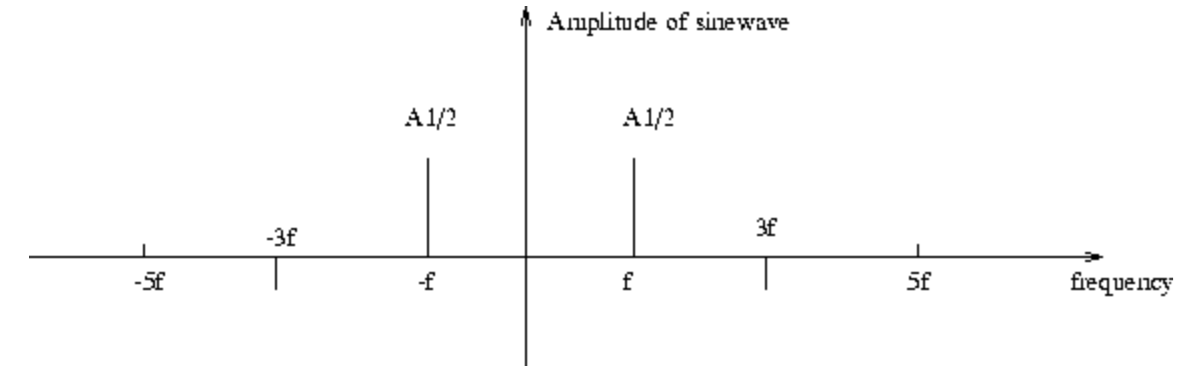

- Cyclical regression estimates oscillatory parameters and turning points.

- Supervised models map feature states → probable path distributions.

- Cohort seasonality adds context (decennial, election, day-of-month, etc.).

- Explainability keeps outputs audit-friendly: drivers, timestamps, and change notes.

What teams get out of it

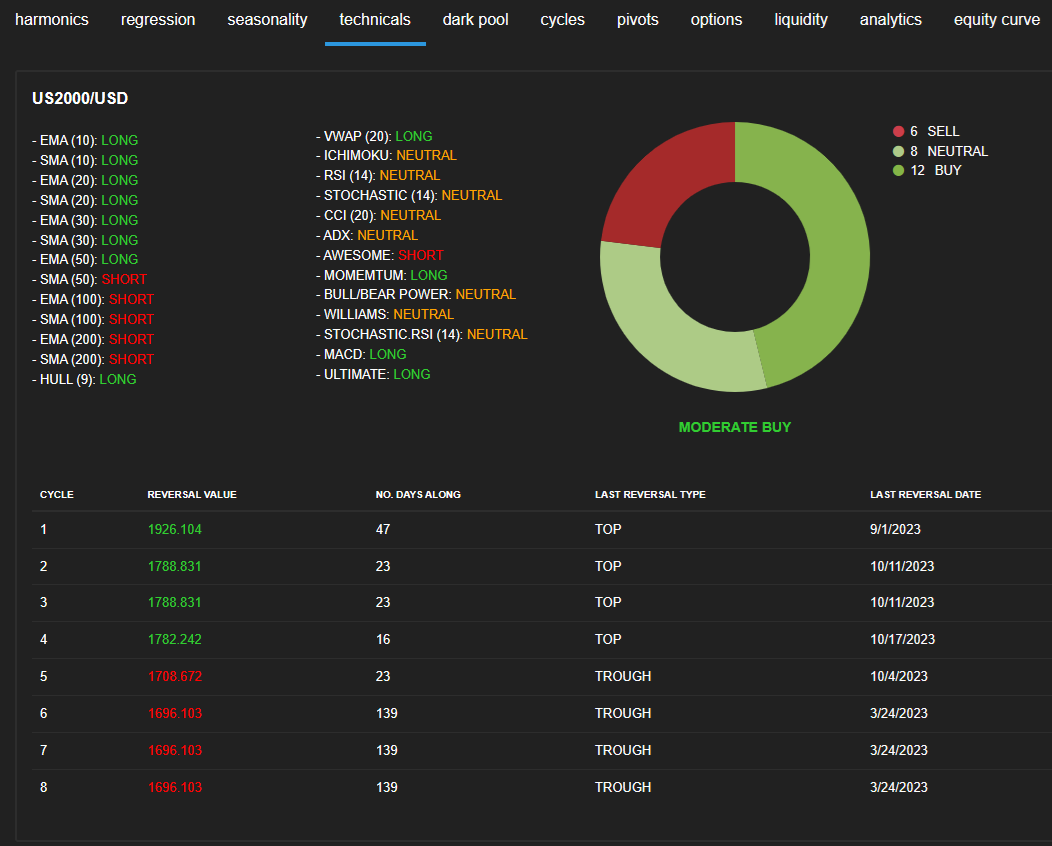

Decision-ready signals

Direction, confidence, strength, and “what changed” — built for weekly cadence.

Reversal zones

Practical levels to plan TP/SL, invalidation, and hedge triggers.

Regime + cohort context

Seasonality cohorts reduce whipsaw and clarify when a signal is “in character.”

How the ML pipeline works

Built to reduce overfit risk: we separate “structure detection” from “forecasting,” then publish outputs with explainability your team can review.

Decompose & detect

Dominant harmonics + trend/momentum features summarize the state.

Filter & align

Cycles are filtered and aligned with regime + cohorts to reduce noise.

Project & explain

Supervised models output path probabilities + reversal zones with drivers.

Reversals, trends & momentum

The model publishes reversal zones for planning, alongside composite trend/momentum context — helping teams avoid reactive, narrative-driven positioning.

See it on your universe

We’ll run the workflow end-to-end on representative assets from your universe: feature state → projection → reversal zones → decision boundaries → reporting cadence.